How KalqiX Achieves Sub-10 Millisecond Latency — Engineering Breakdown for Non-Engineers

When traders see “Sub-10ms Latency” on the KalqiX website, the first reaction is usually: “How is that even possible on a decentralized…

When traders see “Sub-10ms Latency” on the KalqiX website, the first reaction is usually:

“How is that even possible on a decentralized exchange?”

It’s a fair question.

Most DEXs run at the speed of block confirmation —

5 seconds, 10 seconds, sometimes even minutes.

Even the fastest AMM-based DEXs rely on blockchain state updates that introduce significant lag.

KalqiX, on the other hand, delivers execution speeds comparable to top centralized exchanges, while still maintaining:

• Self-custody

• zk-verifiable execution

• Full transparency

• No platform control

This combination is extremely rare.

So how does KalqiX achieve such low latency — without sacrificing decentralization or trustlessness?

Let’s break it down in a way anyone can understand.

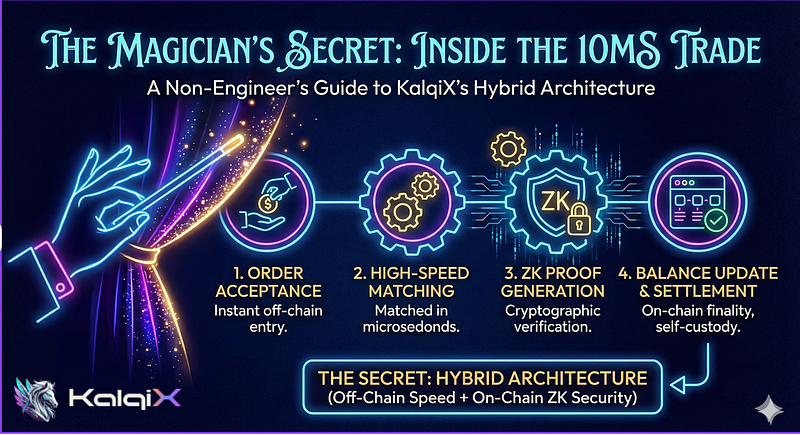

1. Execution Happens Off-Chain — Verification Happens On-Chain

Traditional DEXs try to do everything on-chain:

• Order submission

• Matching

• Settlement

This is slow by design.

KalqiX solves this by separating two layers:

Off-Chain Layer → High-performance order matching

On-Chain Layer → zk verification and settlement

Instead of waiting for blockchain blocks, KalqiX matches orders instantly using an optimized, event-driven engine.

But to stay trustless:

• Every batch of trades is converted into a ZK Proof

• That proof is submitted on-chain

• The blockchain verifies the correctness of the entire batch

This gives KalqiX the speed of a CEX —

without turning into a CEX.

2. In-Memory Orderbook — The Key to Speed

Most DEXs build their orderbook in smart contracts.

That means:

• Slow reads

• Slow writes

• High gas cost

• Latency that can never go below blockchain speed

KalqiX solves this by running the orderbook in-memory, just like professional trading engines used by:

• NYSE

• Nasdaq

• Binance

• High-frequency trading systems

Benefits:

• Nanosecond-level updates

• Instant matching

• No disk or blockchain bottlenecks

• Perfect environment for market makers & active traders

This is why traders say KalqiX “feels like a CEX.”

3. Event-Driven Architecture — Designed Like Wall Street Exchanges

Traditional DEXs use polling or block-based triggers.

KalqiX uses a true event-driven architecture.

This means:

• Every new order

• Every cancel

• Every modification

…triggers immediate logic execution with no waiting.

This reduces latency dramatically because the engine reacts the moment something happens, not when a block is mined.

It’s the same architecture used by:

• CME

• Euronext

• High-throughput financial venues

Except KalqiX adds zero-knowledge proofs on top.

4. Deterministic Matching Logic — Critical for ZK Proof Generation

To generate ZK proofs efficiently, the matching engine must behave deterministically.

This means:

• Same input → always same output

• No randomness

• No ambiguous behavior

• No special ordering rules

• No hidden prioritization

KalqiX’s matching rules are:

• Strict price-time priority

• FIFO order queues

• Deterministic matching sequences

• Predictable state transitions

This makes proof generation fast and ensures fairness.

Determinism = performance + verifiability.

5. Batching for Proofs — Instant UX + Trustless Settlement

Here’s the genius part:

Trades happen instantly for the user (sub-10ms)

Proofs are generated in batches for the blockchain (100–500ms or more)

This creates two major benefits:

1. Traders get immediate execution

2. The chain only verifies aggregated computation

This massively reduces verification costs, making KalqiX scalable to:

• Tens of thousands of orders per second

• Global high-frequency trading

• Institutional volumes

The UX is instant.

The settlement is trustless.

6. Optimized Networking — Built for Global Performance

KalqiX uses:

• Low-latency network transport

• Websocket-based real-time updates

• Geo-distributed routing

• Latency-aware request handling

This ensures that:

• Orders reach the engine within microseconds

• Matching happens in milliseconds

• Users around the world get consistent performance

You don’t need a Bloomberg terminal to feel the difference.

7. Private Orderflow = No MEV = Faster Execution

In most DEXs, your order is visible before it executes.

This causes front-running, back-running, and sandwich attacks — all forms of MEV.

Traders lose money.

Latency increases.

Execution becomes unpredictable.

KalqiX encrypts orderflow and only reveals proofs, not sensitive details.

This gives:

• Faster execution

• No waiting for block miners

• No submission delays

• No gas wars

• No MEV attacks

Private orderflow = clean, efficient, reliable execution.

8. No Blockchain Bottlenecks — And No CEX Risks

KalqiX does not wait for:

• Block confirmations

• L1 congestion

• Node propagation

• Miner inclusion

All these slowdowns disappear.

At the same time, KalqiX does not introduce CEX-style issues like:

• Hidden matching rules

• Off-book trades

• Insider manipulation

• Fund custody risk

Because everything is proven using cryptography.

This is why KalqiX is called a vApp — a verifiable app.

The Result: A New Benchmark for Decentralized Trading

KalqiX achieves sub-10ms latency because its architecture is built for speed from the ground up:

• Off-chain engine

• On-chain proofs

• In-memory orderbook

• Event-driven architecture

• Deterministic matching

• Private orderflow

• Optimized networking

• Batching + zk settlement

This combination has never been achieved in the DEX world at this scale before.

KalqiX gives traders:

• CEX performance

• DEX custody

• zk verifiability

• Fair execution

• MEV protection

• Institutional-grade latency

It is the fastest decentralized exchange architecture ever built — and a blueprint for the future of trading.

Conclusion

Low latency isn’t just a number.

It’s a competitive advantage.

It means:

• Better fills

• Less slippage

• Fairer markets

• More efficient liquidity

• Professional-grade execution

KalqiX brings Wall Street performance to the blockchain world — without sacrificing trustlessness or privacy.

This is the future of trading:

fast, private, transparent, and cryptographically verifiable.

Join us:

Website: www.kalqix.com

Testnet: testnet.kalqix.com

Twitter: https://x.com/kalqix

Telegram: https://t.me/kalqix

Discord: https://discord.com/invite/rmkkKvFDXv

Your funds. On chain. Verifiable.